Despite efforts and trends to slow the growth of U.S. national health expenditures, we have just 7 years until we experience insolvency in the Medicare Part A trust fund, otherwise known as the Hospital Insurance (HI) Trust Fund. This is according to the 2019 Annual Report published by the Board of Trustees for Medicare.

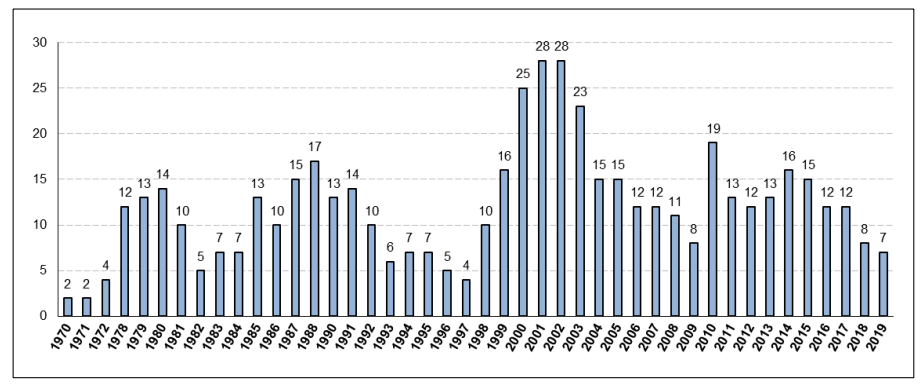

Projected Number of Years Until Hospital Insurance Insolvency

Source: Congressional Research Services, Medicare Financial Status: In Brief, July 2, 2019, Figure 2

What is Medicare Part A?

Medicare Part A covers inpatient hospital services, skilled nursing care, hospice care, and some home health services. Most individuals qualify for free Medicare Part A once they or their spouse have paid Medicare payroll taxes for at least 10 years (40 quarters). Medicare Part A does not apply to coverage for physician and outpatient costs, or prescription drug benefits; these parts of Medicare (Parts B & D) are supported by a separate trust.

How the Trust Fund Works

HI trust operates on a pay-as-you-go basis; the taxes paid by current workers and their employers are used to pay Part A benefits for today’s Medicare beneficiaries. When the government receives Medicare revenues (payroll taxes), income is credited by the Treasury to the HI Trust Fund. This however, gets pooled into the general fund of the Treasury and is indistinguishable from other cash in the general fund. This cash may be used for any government spending purpose. When payments for Medicare Part A services are made, the payments are paid out of the general treasury and a corresponding amount is deleted from the HI Trust Fund. In years in which the trust fund spends less than the income it receives, it shows up as an asset. If the HI Trust Fund is not able to pay all current expenses out of current income and accumulated trust fund assets, it is considered to be insolvent. NOTE: The trust fund surpluses are not reserved for future Medicare benefits.

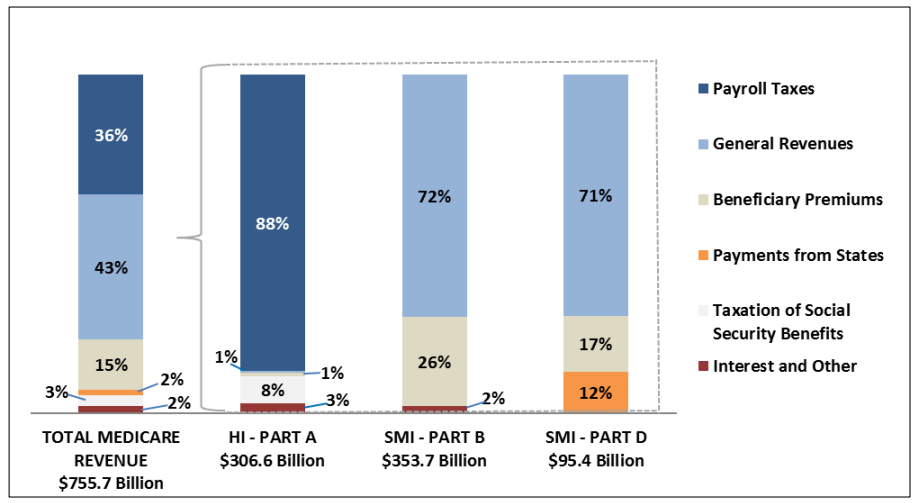

Sources of Revenue for Medicare Part A

The HI Trust is primarily funded by payroll taxes, paid out by both employer and employee. Other sources include premiums paid by voluntary enrollees that are not eligible for premium-free Medicare Part A. In addition, some of the federal taxes paid on Social Security benefits are allocated to the HI Trust, as well as interested on federal securities held by the trust.

Source: Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The 2019 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 22, 2019, Table II.B1

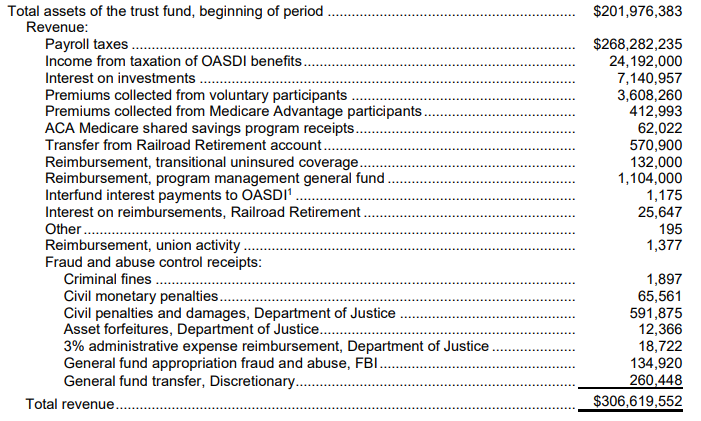

Source: Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The 2019 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 22, 2019, Table III.B1.

Current State of the HI Trust Fund

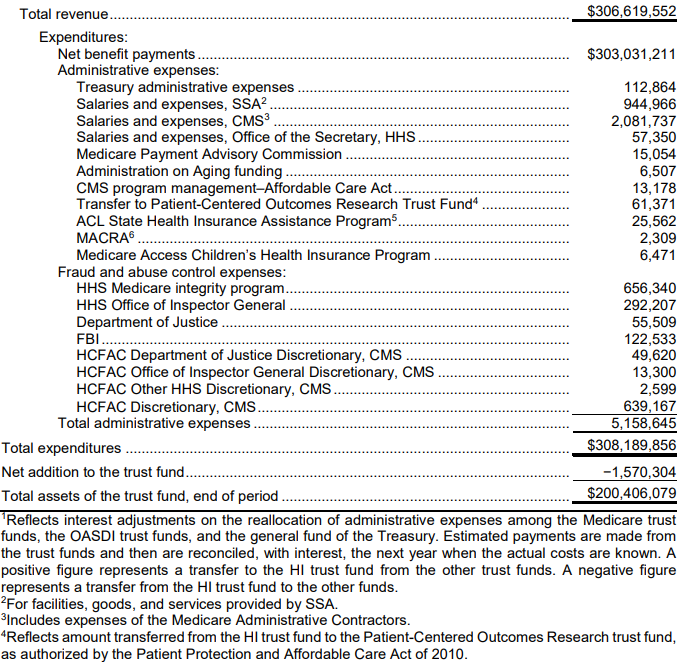

According to the Medicare trustees, 2018 marked the first deficit in nearly a decade, after experiencing a shortfall of roughly $1.6 billion; ending 2018 with a balance of +$200.4 billion.

Source: Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The 2019 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 22, 2019, Table III.B1

Of the total Expenditures, the majority of funds were paid to hospitals at nearly $146.4 billion and an average of $5,086 per beneficiary for inpatient costs, alone.

Source: Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, The 2019 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds, April 22, 2019, Table II.B1

Compared to Prior Reports

According to the Congressional Research Services, these latest projections are in line with those that the trustees have reported on for some time. Since 1970, changes in the law, the economy, and other factors have brought the projected year of Medicare HI insolvency as close as two years away or pushed it as far as 28 years into the future. According to a comparison done by the Congressional Research Service. The estimated depletion date of the HI Trust Fund is 2026, the same as projected in the 2018 report. They did note however, that over the next 75 years, the estimated amount that would need to be added to the payroll tax to maintain HI solvency for this period increased slightly, by 0.09%—from 0.82% of taxable payroll in the 2018 report to 0.91% of taxable payroll in the 2019 report

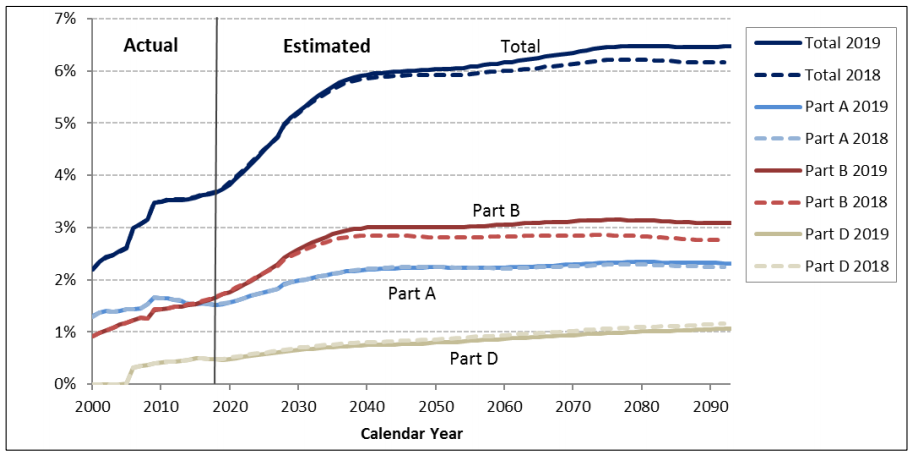

Comparison of 2018 and 2019 Medicare Expenditure Projections

Source: Congressional Research Services, Medicare Financial Status: In Brief, July 2, 2019, Figure 5

What’s To Be Done?

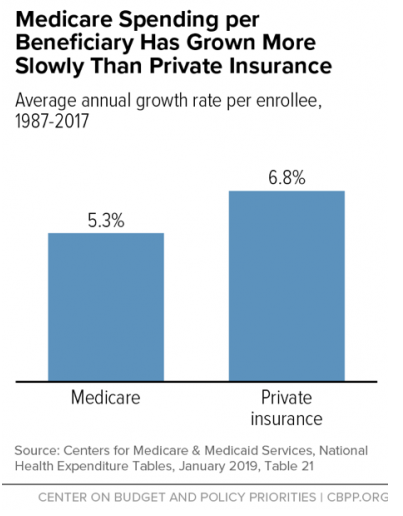

Medicare has been leading the charge to reform the healthcare payment system through the ACA, Quality Payment Program (QPP), and the CMS Innovation Center (CMMI). Despite its best efforts though, Medicare continues to post long-term budgetary challenges due to the aging population and continued rise in health care costs.

It’s likely that we will continue to see CMMI push for new pilot programs aimed at efficiency. We’ll see continued pressure on the pharmaceutical companies, over drug costs; as well as focused efforts on detecting fraudulent and wasteful Medicare spending; and reduced payments to Medicare advantage and health care providers.